Table of Content

Cash apps are mobile applications that allow an individual to perform electronic transactions – transferring money digitally with the aid of mobile devices. Cash apps are rapidly becoming the most preferred means to carry out digital transactions such as buying a product online, transferring money to someone else’s bank account, charging your cell phone, or even paying your home electricity bill.

Image Credit: businessinsider.com

Image Credit: businessinsider.com

Top 10 cash apps in the market

1. Google Pay

Google Pay has fused the best features of Google Wallet and Android Pay to offer online money transactions. Once you have successfully verified your phone number and bank account, simply select your contact to send money to.

Currently, Google Pay doesn’t charge a fee.

There are additional options to transfer money to bank accounts by entering the recipient’s account details such as account number and IFSC code.

Download the app at Google Play or Apple Store.

2. Apple Pay

Just like Google, Apple has come up with its own payment services app popularly known as Apple Pay. It uses Near Field Communication (NFC) for secure payments. NFC technology enables different devices to communicate. You can perform digital money transactions between contactless payment terminals and any device where the Apple operating system runs.

Apple devices such as Apple Watch, iPhone 6, iPhone 6 Plus and iPad can use Apple Pay. For any digital money transaction, simply hold the device near a contactless POS and simultaneously touch the Touch ID with your finger, which will serve as the passkey.

Apple Pay is unique compared to other payment apps because of its security mechanism called tokenization. Here the application creates virtual account numbers instead of saving real credit card numbers on its servers. A unique device account number is assigned, encrypted, and stored inside a dedicated chip.

In case you need additional security, you can opt for an additional 6-digit PIN as well.

Setting up Apple Pay.

3. PayPal

PayPal is a great application when it comes to sending money across the globe. The app is available in more than 200 countries and supports over 25 currencies.

Simply link your bank account to your PayPal id, and once the account is active, you can transfer money instantly to any other PayPal account holders out there.

In addition to sending money, PayPal is an excellent service when you need to receive money from foreign countries, especially if you don’t want to reveal your bank details.

PayPal has a business account as well, which enables business owners to accept card payments.

PayPal also works on web browsers. To pay online, all you need to do is to look for the PayPal logo and follow their simple instructions on the screen.

Download the app at Google Play or Apple Store.

4. Samsung Pay

Samsung pay can work anywhere where a card swipe option is available. It uses Magnetic Secure Transmission (MST) technology, which replicates a card swipe, and is accepted by standard card readers.

MST works by replicating magnetic waves from the Samsung device and transmitting it to the standard card reader.

For making contactless mobile payments, Samsung Pay also uses NFC.

For merchants, this is a great boon, as they can accept mobile payments without upgrading their device.

The app is securely locked by a 6-digit PIN or fingerprint.

Download the app at Google Play. Not available on iOS devices.

5. Square Cash App

Square Cash App enables you to send money and make purchases through peer-to-peer payments. Ever since the service began in 2009, it has over 7 million registered users.

To send money, the user doesn’t need to sign in, but to receive payments, a sign-in process is required.

The user can send money or request money from anyone who has a Square Cash account.The fund transfer happens directly from the registered bank account via debit card and is free of charge.

The app comes with many cool features and is fully compatible with both Android and iOS platforms. You can link debit cards, including Amex, Visa, MasterCard and Discover. You can directly add your bank account for a direct deposit or add cash to your Square Cash account.

Recently, the app added an update to sell or buy Bitcoin.

You can protect your payments through Touch ID, passcode or Face ID. You will be informed of your account usage through email or text notifications to ensure no unauthorized transactions take place.

Download the app at Google Play or Apple Store.

6. Venmo

When it comes to cash apps, Venmo has many interesting features and functionality, including the ability to like and comment on every transaction. If you link Venmo to your Facebook page, it can search through your friends’ list and let you know who are using the app.

Venmo works by linking with your bank account and credit / debit cards, and all transactions are secured and encrypted.

For credit card transactions, a standard fee of 3% will be levied. Debit card transactions and bank transfers are free.

Download the app at Google Play or Apple Store.

7. Xoom

Xoom is another cash app which is owned by PayPal. With Xoom, it is easy to send payments in 66 countries. The app is designed for both Android and iOS users.

Senders need to be registered with the Xoom app. Cash recipients don’t need to download the app but they should have an active PayPal account.

Image Credit: businesswire.com

Image Credit: businesswire.com

Xoom gives a variety of options for the sender to send money to bank accounts, specified locations, or cash pickup points.

The transaction charges depend on the amount of money and the payment methods. For international transactions, Xoom levies an additional amount for currency conversions.

Download the app at Google Play or Apple Store.

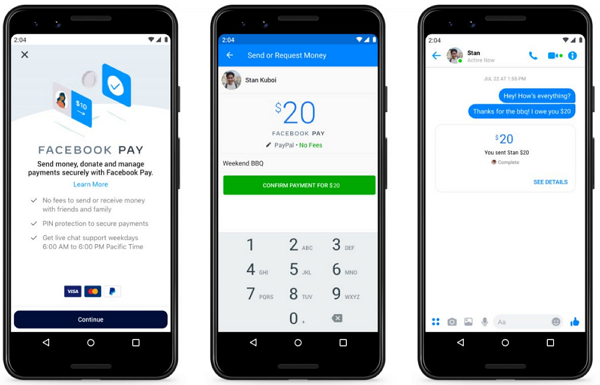

8. Facebook Pay

Facebook Pay is a recent initiative allowing users to send money through their Messenger application.

Image Source: businessinsider.com

Image Source: businessinsider.com

Users can link their debit card details. To send money, simply click on the “$” icon that can be found in the chat box, enter the amount, and transfer away.

Download the app at Google Play or Apple Store.

9. Zelle

If you want to quickly send money to your friend without the hassle of signing up with an app, Zelle is a great choice.

Zelle requires its users to have a US bank account and comes in handy when making split payments. For example, if you are living with a few housemates, you can request for everyone’s share of their water, electricity and internet payment digitally via Zelle. They don’t have to run to the nearest ATM for cash.

Zelle is a remarkable peer-to-peer payment service designed and developed by Early Warning Services.

Zelle partners with over 65 banks, and is used by more than 85 million US consumers through various mobile banking applications. If you have an account with any of the participating banks, you can make an instant cash transfer to anyone who has an account at any of the listed banks.

Even if your bank hasn’t partnered with Zelle, you can still send and receive money just like any other P2P cash services.

Zelle withdraws cash directly from the sender’s bank account and makes an instant deposit to the recipient’s account. Users can also request or receive money by using a registered mobile number or email address.

Download the app at Google Play or Apple Store.

If you’re looking for a Mobile App Developer, your search ends here! Techies is one of the renowned mobile app development company in Malaysia has what it takes to bring your digital ideas come to life. Reach out to them!